Blankets, we’ve got blankets, we’ve got lots and lots of blankets and we’re

giving them away. Yes, the wool blankets have been in storage for a number of

years (emergency preparedness program supplies) and its time to repurpose

them. Actually, were trying to find Preston residents that would be interested in

accepting a wool blanket. They most likely will need a good cleaning when you

take them home too. If your interested in taking a green wool blanket, or two,

please leave your name and telephone number at the Senior Affairs Office 860-

887-5581 ext. 6. I will make arrangements to bring the blankets to the senior

center for pick-up. Remember, they are absolutely FREE and are waiting to keep

you warm and toasty.

Category: Resources

Seniors Farmers Market Vouchers

- Eligibility is 60 years of age or older OR disabled under the age of 60 who lives in senior housing where congregate nutrition services are provided. Income of not more than 185% poverty guidelines ($2,322/month or $27,861/annual for household of 1; $3,151/month or $37,814/annual for household of 2, etc). Participants can go through means testing to support income eligibility (i.e., SNAP or Medicaid).

- Cards can be used to purchase only CT grown fruits, vegetables, fresh cut herbs and honey.

- Cards can only be accepted at authorized locations (a list of farm markets and farm stands will be provided). It is likely possible to coordinate “pop-up” markets at a senior center or other location if working with an authorized farmer.

Please contact the Senior Center if you are interested in receiving a Farmers Market Voucher. Please contact Senior Resources directly at 860-887-3561.

Register for the Summer Session

SUMMER SESSION: JULY 1st – SEPT 20th 2024

Registrations begins at 9am:

Jun 10th for Residents

Jun 17th for Non– Residents

If you register online, we must receive payment by the end of the next business day. Registrations by phone will not be accepted on registration day. Registrations are not guaranteed until we receive payment.

Make Up week will be the week of the September 23rd.

Director’s Note

Dear Members,

I want to express a hardy thank you to all those that attended your town meetings approving additional monies that we needed to build our senior center. Your presence was overwhelming and appreciated! Although we do not yet have a specific date for our groundbreaking ceremony, I have been informed that it will be sometime mid-May. We will send out an email as soon as we know in hopes that you can attend.

On a different note, we have now officially been out of our building for 6 months. During this time our members have been so flexible and have accommodated the changes in locations well so thank you. A special thank you to all of the organizations that have helped keep our community active and intact. These include The First Congregational Church of Old Lyme, Saint Ann’s Episcopal Parish, Roger’s Lake Clubhouse, Lyme Library, Old Lyme Library, Lymewood, Dance Studio of Old Lyme, & Old Lyme Town Hall. In the future we will also be using Soundview Bocce Courts, Florence Griswold Museum Grounds, and Christ the King Church.

Our Outdoor Summer Concert Series will take place at the Florence Griswold Museum Grounds and we will be co-hosting the event with them. The concert dates will be Friday, July 5th, Thursday, July 11th, Thursday July 18th, and Friday July 26th. The Flo Gris will have a food truck on site for these concerts. Please see next month’s newsletter for more details.

For the months of June and July our lunches will be held at Christ the King Church on Tuesdays,

Wednesdays, and Thursdays. Hope you can join us there!

Best regards,

Stephanie Gould, Lymes’ Senior Center Director

Elderly and Disabled Homeowner Program

May 15th is right around the corner and if you haven’t scheduled your

appointment to complete your application, time is running out! If this is your year to reapply, you would have already received a letter from the Town of Preston Assessor inviting you to reapply. Additionally, you would have received a

reminder call from my office too. For individuals who still hadn’t responded,

another letter was forwarded to again remind you of your need to reapply. We’re

trying to help you continue this benefit but, we can’t do it alone. To schedule an

appointment, please call the Senior Affairs Office at 860-887-5581 ext.6.

It’s Budget Time!

Yes, it’s that time of year when the General Government and Board of

Education budgets are presented to the public for discussion. Have you ever

attended one of the Public Hearings? Do you wait for your property tax bill to

arrive and say “This is crazy, what’s going on?” This is your opportunity to get the

real story on what the driving forces are behind those tax bills. Don’t voice your

concerns after the fact, be proactive and make a difference.

Public Hearing: April 25th at 7:00 p.m. in the Preston Veterans Memorial School gymnasium, Route 164, Preston

Town Meeting: May 9th at 7:00 p.m. in Preston Veterans Memorial School gymnasium, Route 164, Preston

Referendum: May 23rd, (time to be announced) Preston Plains Middle School, Route 164, Preston.

Your voice does matter!

Rental Rebate

We will be completing applications for residents in elderly housing on the following dates:

LEDGEWOOD MANOR – Tuesday May 14th from 10-11:00am

ASHLAND MANOR – Tuesday May 21st from 10-11:00am

MCCLUGGAGE MANOR – Tuesday May 28th from 10-11:00am

TO SET UP AN APPOINTMENT CALL THE SENIOR CENTER.

Deterra Drug Deactivation and Disposal System

Dispose of unwanted medications properly to prevent misuse and to protect the environment.

The Deterra Drug Deactivation and Disposal System is a safe medication disposal pouch that can be used at home. It is an effective way to destroy unused, unwanted and expired medications with the simple addition of tap water for safe disposal in the trash.

Please ask at Reception if you would like a bag.

Farmer’s Market Cards

Will be distributed on:

Tues. June 11th,, Wed. June 12th, and Thurs. June 13th from 9:00 a.m. – 11:00 a.m.

Farmer’s Market cards are available to low income seniors who meet certain eligibility requirements.

You must meet the following Eligibility Requirements in order to receive a benefit card:

¨ You must be 60 years or older. If you are under 60 and disabled you must meet eligibility requirements and live in housing facilities occupied primarily by older individuals where congregate nutrition services are provided.

¨ Yearly income not to exceed $26,973 for single or $36,482 for couple.

¨ Must be participating in another need based program that verifies income eligibility such as Renter’s Rebate, Congregate Meal Program, Medicaid, SNAP (Foodstamps), etc.

¨ You must be a resident of the town you receive the benefit card from.

Limit of one card per eligible senior annually.

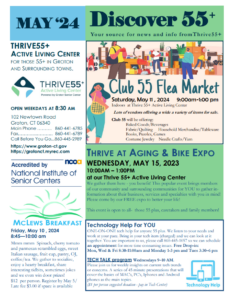

On-Line Thrive 55+ Newsletter Subscription

Have you signed yourself up for a online newsletter yet? You should as you will get access to it all before the printed ones get here to our center. Page 8 has our popular day trips! https://mycommunityonline.com/publication-page/thrive-55-active-living-center?pid=842d82a8-cc71-4209-ae4c-1475f042db0e&type=Community&acc=06-5014