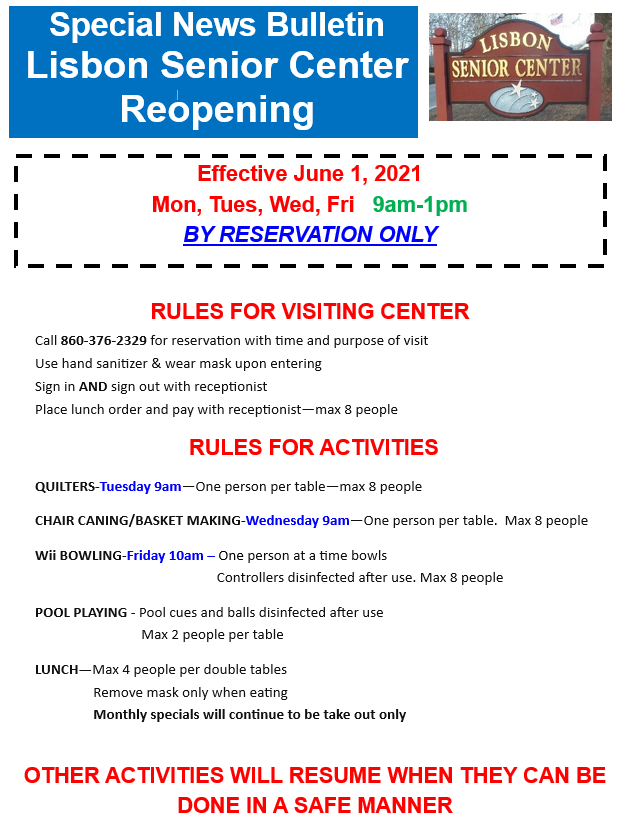

Lisbon Senior Center is Open to the Public

Call 860-376-2329 to reserve a day/time

Thursday, June 15th at 11:30am- Walk through Take Out Luncheon

Menu: Pulled Pork/Coleslaw/Dessert

Cost: $5.00

Orders must be placed no later than July 7th. Call senior center for deadline.

Call 860-376-2329 to sign up

MASKS & 6’ SOCIAL DISTANCE REQUIRED ENTER THROUGH FRONT DOOR AND EXIT THROUGH LIBRARY DOOR

Change with Lunch orders

Lunch orders should be called in ahead of time and payment will take place when checking in at the reception desk.

Updated Information about Bingo

Bingo is still on Thursdays with a new time. Cards will be sold at 9:30 and

bingo will begin at 10:30. Lunch will be served at 11:30 and bingo will

resume at 12:00