- Needle-stick injuries that cause infection and spread disease;

- Injuries to curious children, waste haulers, recycling workers, and animals;

- or Needles washing up on our beaches and riverbanks.

- Seal them in rigid, puncture-resistant containers that you can’t see through (i.e., bleach or detergent bottles, coffee cans, etc.);

- Label the containers “Do Not Recycle,” and,

- Reinforce containers with heavy-duty tape before throwing them in your

household trash. - Throw loose needles in the trash;

- Flush needles down the toilet:

- Place needles in soda bottles, cans, or glass containers’ or,

- Put sharps containers in the recycling bin.

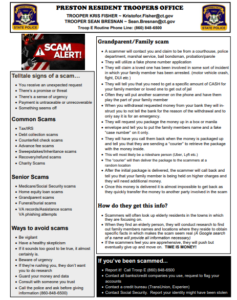

Scam Alert from Preston Resident Trooper

Citizen’s Guide to the Budget Process

President’s Day Closure

The senior center will be closed on Monday, February 20th for President’s Day

Disposal of Sharps by Uncas Health District

Sharps used at home are not regulated as Biomedical Waste. However,

throwing them in the household trash or flushing them down the toilet presents

serious risks for both you and others who may come in contact with such items.

Improper disposal of sharps can lead to:

The Connecticut Department of Energy and Environmental Protection recommends checking with your supplier (i.e., your physician, local hospital, or pharmacy) to see if they are willing to accept properly packaged used sharps. Some companies even offer mail-back disposal services to their customers.

To properly dispose of sharps:

DO NOT:

** Scam Alert **

Staff and clients have begun reporting messages appearing to be from DSS

regarding their EBT card and Renewal. These messages are scams, individuals

should not call back the number listed on the text message. DSS has not yet

started texting clients regarding renewals.

It asks for the caller to enter their card number and PIN in an attempt to

steal their benefits.

Messages from DSS will only be sent from the BC (Benefits Center) Number,

which is 1-855-626-6632 and will only direct individuals to www.mydss.ct.gov, and will contain the first name and the last 4 digits of the client id.

If the individual called the telephone number back and/or provided someone with their card number/PIN via telephone, they should immediately call and change their EBT PIN by calling the EBT phone line: 1-888-328-2666.

In addition, the individual should check their EBT balance either through that

number or online at www.mydss.ct.gov. If it appears that they have stolen your

benefits, you should contact your local police department.